Apps Home

Fast Budget - Expense Manager

Simple and Effective Budget Management

Managing a budget effectively is crucial for personal and family financial health. The ability to track income, expenses, and overall financial health with ease can make the difference between financial success and struggle. With the right tools, you can stay on top of your financial situation and make informed decisions without stress.

Understanding Your Budgeting Needs

Before diving into tools and methods, it’s important to understand your personal budget needs. Identify the areas where you spend the most, and determine what financial goals you want to achieve. This approach ensures you choose the right method and tool for your specific situation.

Using Technology to Your Advantage

Modern technology offers several tools to help manage your budget effectively. Applications on various platforms allow you to track expenses, income, and even savings goals. For Android users, consider downloading an app via this link.

Features of Fast Budget - Expense Manager

The Fast Budget app offers a range of features to help users manage their finances effortlessly:

Accounts and Credit Cards

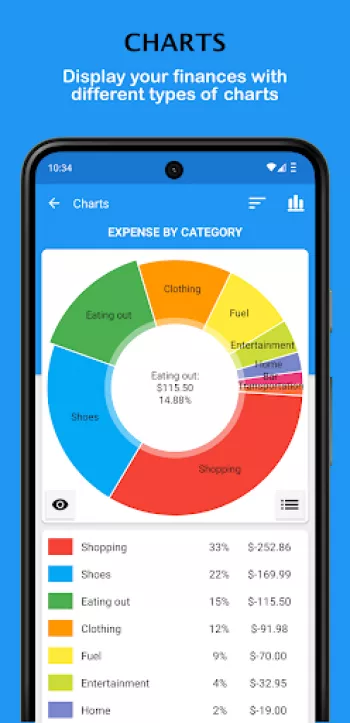

Stay aware of your bank accounts and credit card activities. Customizable charts are available to help visualize account balances and spending trends.

Transactions and Scheduled Transactions

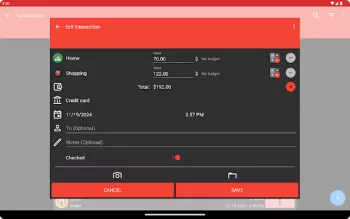

Easily record revenues and expenses. Use transaction templates and widgets to simplify this process. Schedule recurring transactions with reminders for due dates.

Budgets

Create and manage custom budgets by category. Discover how much you have left to spend during each budget period, with the ability to adjust timespans and include multiple categories.

Debts

Monitor your debts and credits in a dedicated section, whether it's towards banks, friends, or other entities.

Calendar

See a day-by-day overview of your spending and income. Maintain awareness of how much you are spending and when.

Synchronization and Data Export

Synchronize data across up to five devices. Export data in various formats, including PDF, CSV, and XLS, and keep data secure with Dropbox backup and passcode protection.

Leveraging Budget Tools

The right tool can transform your budgeting experience. Ensure any app you use meets your needs in terms of feature set and ease of use. Opt for apps that offer syncing capabilities and customizable features.

Planning for the Future

Effective budget management is not just about tracking current finances; it’s also about planning for the future. Use budgeting tools to set savings goals and forecast financial outcomes.

Final Thoughts on Budget Management

Managing a budget with ease and effectiveness is within reach with the right approach and tools. Understand your needs, leverage technology, and build a financial strategy that aligns with your goals. As you track expenses and set evolving targets, your financial health will likely improve, leading to greater opportunities and peace of mind.

شاركنا رأيك

بريدك الالكتروني لن يتم نشره.

All Rights Reserved © Apps Home 2025

lei

Easy to use and practical!! Super helpful app. I would, however, appreciate it more if it also shows the total & average expense per category. That...

A Google user

For me, this app was easy to learn. Once your expenses and income categories are set up on the app, it's a cinch to record each item. I upgraded to...

A Google user

After trying about a ~20 different app, this is hands down the best money-tracking app I've ever used! The one thing I would like to see is an asth...

Nicole S

After trying over 20 apps, I revisted this one. I would consider it more indepth than fast, esp compared to simple budgeting apps but now that I'm ...

A Google user

I tried out many budgeting apps before finding this perfect one. It is very simple to use and allows you to add multiple accounts, as well as credi...