Apps Home

Understanding the Fundamentals of Effortless Personal Finance Management

The core of effortless personal finance management lies in building a deep understanding of your financial ecosystem. Finance is not just the underlying numbers—it represents aspirations, security, and lifestyle choices. An essential part of this is comprehensively managing every financial aspect, be it budgeting, saving, investing, or spending. It is crucial to view financial management not just in terms of income and expenses but to integrate it with the goals you wish to achieve. First, crafting a reliable budget is foundational—it serves as the blueprint for financial discipline. Track your monthly income streams against your expenses to identify patterns. By meticulously documenting every dollar that comes in and flows out, you reveal inefficiencies and opportunities for optimization. While this might appear overwhelming initially, leveraging modern tools such as finance management apps can automate much of this process. This is the essence of effortless finance. These tools can monitor and categorize expenses, track investments, and ensure that bills are paid on time without constant manual intervention. For example, with apps like Discover’s Mobile App, you gain the power to manage credit card and banking activities seamlessly from your mobile device. This integration not only enhances convenience but fortifies your budgeting process by providing real-time insights into your financial situation. With such systems in place, the traditional stress associated with personal finance can be greatly diminished, paving the way for a more secure and prosperous life.

Digital Tools and Techniques for Optimizing Financial Management

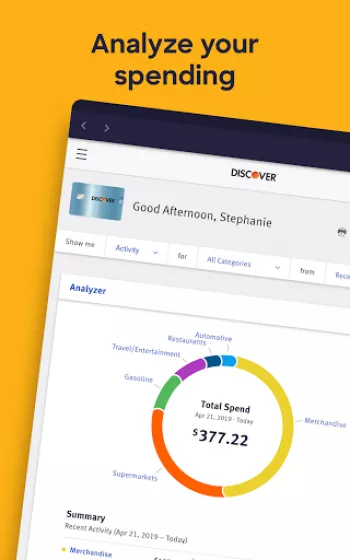

In the digital age, leveraging technology can transform how you manage your finances profoundly. Mobile apps have revolutionized the accessibility and ease of financial oversight. These apps offer an unprecedented level of control and insight by bringing all necessary financial tools under one virtual roof. For instance, using the Discover Mobile App ensures fast account access with features like a 4-digit passcode, allowing you to monitor account balances, transaction activities, and monthly statements effortlessly. What's pivotal here is the role of such apps in planning and executing financial strategies. They enable continuous tracking and provide analytical insights that would otherwise require considerable manual effort. In fact, these tools are designed to provide a seamless experience by integrating features like Quick View to display account information without the need for logging in, thus saving valuable time and offering peace of mind. Furthermore, the concept of managing rewards becomes significantly easier—users can redeem rewards as an electronic deposit, for gift cards, or use them towards monthly billing, which exemplifies the app's capability to enhance financial flexibility. These apps also provide credit score tracking and allow account freezing and unfreezing to prevent unauthorized activities. The strategic application of these features can yield substantial benefits by simplifying daily financial tasks and minimizing potential risks associated with managing finances in a complex economic landscape. By utilizing these digital innovations, financial management becomes not only more sophisticated but also far more manageable.

Building a Robust Strategy for Long-Term Financial Security

To achieve long-term financial security, it is indispensable to adopt a well-rounded strategy that encompasses savings, investments, and risk management. Financial security is fundamentally about creating a buffer against uncertainties and planning for future aspirations. Start by setting clear financial goals, which can range from acquiring a new skill set to purchasing a home, or funding retirement. Once goals are defined, develop a savings plan that aligns with these objectives and your current financial situation. Consider leveraging high-interest savings accounts or diversified investment portfolios that can offer compounded growth. The Discover Mobile App, for example, aids in this strategic planning by providing tools to track account balances and transaction history effectively, ensuring that savings goals are consistently met. Moreover, effective risk management is integral to safeguarding your finances against unexpected events. This involves maintaining an emergency fund and ensuring sufficient insurance coverage to mitigate financial burdens in unforeseen circumstances. Additionally, keeping a close eye on credit scores through apps and using mechanisms such as card freeze options to prevent unapproved transactions are practical ways to maintain financial health. Regularly reviewing and adjusting your financial plan to accommodate changes in life circumstances and economic conditions ensures that your strategy remains robust and adaptable. Ultimately, the objective is to create a sustainable financial environment that not only supports current needs but also paves the way for achieving long-term dreams and aspirations.

Harnessing the Power of Rewards and Credit in Financial Management

The strategic use of credit and rewards plays a pivotal role in achieving financial efficiency and optimization, particularly when managed through adept tools like Discover’s Mobile App. Credit cards, when used judiciously, provide an opportunity to build credit, access liquidity, and even benefit from rewards programs. These rewards can take various forms, including cashback, points, or miles, which can significantly enhance the value derived from everyday expenditures. However, the key lies in managing these credit accounts astutely by keeping track of balances, payment due dates, and leveraging rewards to offset costs. The Discover Mobile App, for example, provides seamless integration with platforms like Amazon and PayPal, allowing users to maximize rewards by aligning spending with rewards redemption, thus infusing purchases with added value. Additionally, taking advantage of features like free credit score checks helps in evaluating creditworthiness and understanding how lenders perceive financial behavior. Monitoring this closely ensures that users are eligible for better credit terms and benefits in the future. Moreover, the ability to send and receive secure messages with customer service, activate new cards, report losses, and handle travel notifications via the app leads to enhanced convenience and security. In this context, making informed decisions about when and where to use credit and how to utilize rewards effectively becomes part of a broader strategy to minimize expenses and maximize financial gains. By doing so, individuals can leverage the power of credit and rewards to achieve a more financially advantageous position, enhancing overall economic well-being.

Integrating Financial Management into Everyday Life with Modern Solutions

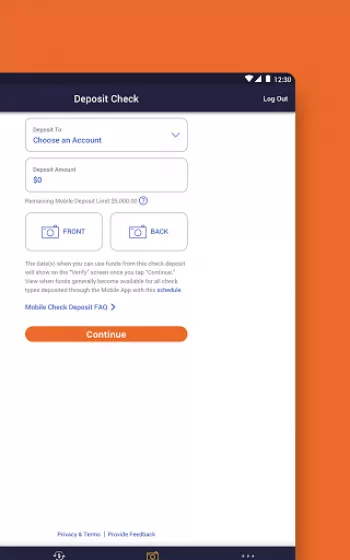

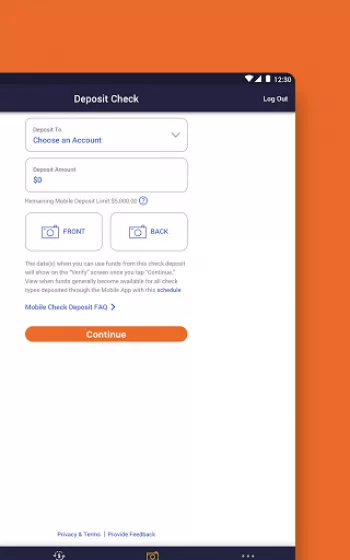

Integrating financial management into daily life requires an approach that blends practicality with accessibility, making it an intuitive and non-disruptive part of an individual or a household's routine. With the vast array of tools and technologies available today, such as the Discover Mobile App, financial management can be woven seamlessly into the fabric of everyday activities. The advantage of these technologies lies in their ability to simplify previously cumbersome tasks into quick, efficient processes, thereby reducing the barrier to regular financial oversight. For instance, with mobile banking options, you can check balances, transfer money, pay bills, deposit checks, and schedule transactions on the go. This brings a level of immediacy and control that traditional banking methods could not offer. Furthermore, the integration of automation for tasks like bill payments and money transfers means fewer chances of missing due dates or encountering cash flow issues. The availability of a secure platform to manage finances also instills greater confidence in handling personal data which is integral to maintaining privacy in the digital age. Tools like ATM finders, along with personalized alerts and notifications, add layers of convenience and security that transform financial management into a seamless experience. Moreover, ensuring compatibility across devices—be it Android, iPhone, or more—is essential to match the diverse needs of users. Thus, by embracing these modern solutions, individuals can redefine their relationship with money—ensuring it serves their goals and enhances their quality of life effortlessly. For those interested in exploring these tools: Download for Android, Download for iPhone.

Share Your Opinion

Your Email Will Not Be Published.

All Rights Reserved © Apps Home 2025

Susan Stone

I use the Discover app exclusively. It's user friendly and I love the quickness and ease of paying my bill each month through the app. Many great f...

Rabecca E

The app can be a bit overwhelming sometimes. However as a whole I can't thank Discover enough for their immediate responses to any issues. They hav...

Cason Anderson

Update: RESOLVED! Back to 5 stars. Good job, Discover! Original: I'm an IT professional and I use DNS filters to prevent apps from tracking me in w...

Wakesha Abigide

This card app is excellent, on your credit, they keep you informed of every transaction that's been preformed! I absolutely love it, also keeps you...

Joseph Collins

Luckily, my phone is still new enough that it's still supported. However, every time the app updates, the shortcut on my home screen disappears! Wh...