Apps Home

The Evolution of Personal Finance Management

In an era where digital transformation is rapidly altering the landscape of various sectors, personal finance management has not been left behind. The advent of smartphones has revolutionized how individuals manage their finances, leading to the development and proliferation of personal finance apps like the "Leading Personal Finance App." These applications have become indispensable tools for millions, catering to diverse financial needs ranging from budget tracking and savings to investments and loans. The Leading Personal Finance App, in particular, offers users a smart and easy way to handle their finances, integrating advanced analytical tools and personalized features to empower users in making informed financial decisions. Historically, personal finance was managed through manual entries in ledgers or simple spreadsheets, methods prone to errors and often insufficient for real-time financial planning and analysis. However, with technological advancement, these methods have become obsolete. The app provides a holistic approach combining mobile banking, personal loans, cashback rewards, and fast cash advance solutions into a seamless user experience. This reflects a broader trend where personal finance apps are no longer confined to basic budgeting but have evolved into comprehensive platforms offering myriad services. By integrating financial literacy resources and real-time data analytics, the Leading Personal Finance App caters to both novices and financial aficionados. The challenge in today's competitive market lies not in accessing these services but in selecting an app that simplifies financial management without compromising on functionality or security. The app's intelligent design ensures that users receive detailed insights into their spending habits and financial commitments, offering tailored advice to optimize their financial health. The provision for playing games to earn real money adds an interactive edge to the otherwise mundane process of financial management, illustrating the innovative paths developers are taking to engage users actively. Furthermore, the availability of this app on platforms like Android and iPhone ensures broad accessibility, while its lack of support for Windows, Linux, and Mac merely reflects a focused strategy to dominate the predominant mobile markets.

Innovative Features and Their Impact

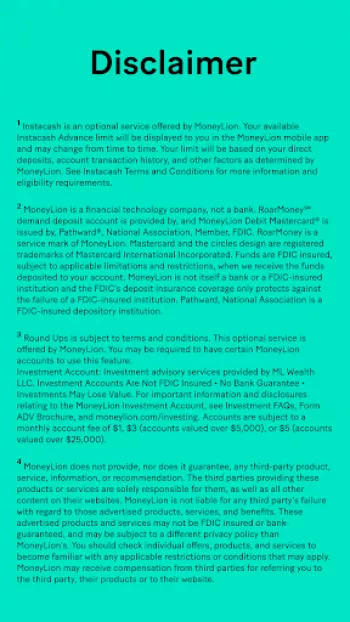

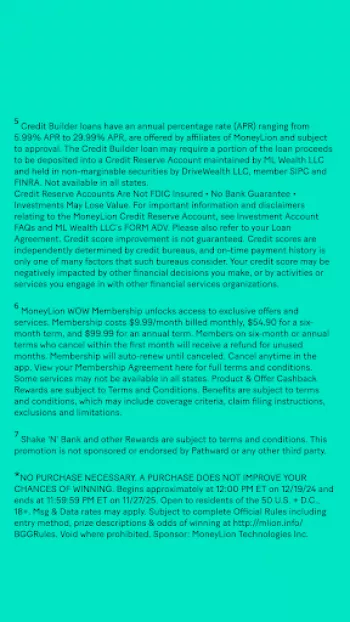

The Leading Personal Finance App stands out due to its array of innovative features designed to provide comprehensive financial solutions. At its core, the app includes traditional banking services under the umbrella of RoarMoney, which allows users to receive their payments up to two days earlier than scheduled. This feature is crucial for individuals living paycheck to paycheck, facilitating better financial stability and planning. Another groundbreaking feature is the cash advance service, Instacash, which offers up to $500 without interest or mandatory fees, allowing immediate access to funds without the burden of a credit check. For users seeking to build their credit score, the app offers Credit Builder loans, up to $1000, complemented by membership-exclusive services. This feature is instrumental for those looking to improve their creditworthiness without resorting to conventional high-interest loans. Additionally, the app seamlessly integrates a cashback and rewards system, incentivizing users' financial engagements and encouraging prudent financial behaviors. The MoneyLion Games feature further differentiates the app by allowing users to play games for fun, earning up to $50 cashback per game. This gamification strategy not only attracts users but also promotes sustained engagement by making financial management entertaining. Furthermore, the app's ability to offer competitive personal loan options through its marketplace is indispensable for users seeking financial products with varied terms and benefits. Through comparison and evaluation, users can select loans most suitable to their needs, facilitated by the app's transparent display of loan conditions such as APRs and repayment terms. The app’s support for Round Ups—where spare change from transactions is invested—also represents an innovative approach towards micro-investing, encouraging users to save and grow their wealth passively. By combining such diverse features into a single platform, the app caters to a myriad of financial needs, transforming the user experience from a simple transaction record to an interactive and beneficial financial journey.

User Accessibility and Experience

The Leading Personal Finance App is intuitively designed to enhance user experience, prioritizing accessibility and ease of use across its platform. With a clean and responsive interface, the app ensures that even the most tech-averse individuals can navigate its features effortlessly. Accessibility is further enhanced by the app’s availability on both Android and iPhone platforms, positioning it strategically across the most widely used mobile operating systems. Although not available for Windows, Linux, or Mac, the focus on mobile accessibility speaks volumes of the strategic direction aimed at capturing the mobile-first population. The app accommodates diverse user preferences by providing customizable dashboards, enabling users to tailor their financial interfaces according to individual needs. This personalization extends to notifications and alerts, where users can opt for reminders on due bills, track spending limits, and receive personalized financial insights. By leveraging artificial intelligence, the app continuously analyzes user data to provide recommendations that align with users’ financial goals, whether saving, investing, or managing debt. The seamless integration with banking services enables real-time tracking of transactions, rendering manual data entry obsolete. Additionally, the app’s gamification elements, through MoneyLion Games, provide a unique element of interactivity, ensuring that financial management remains engaging and never monotonous. These features collectively underscore the app's commitment to making personal finance management not only accessible but also enjoyable, breaking down the conventional barriers that often deter individuals from actively managing their finances. The app thus redefines personal finance through a user-centered approach, accommodating varying levels of financial literacy and ensuring that every user, irrespective of their financial expertise, can leverage the platform to make informed financial decisions efficiently.

Security and Privacy Considerations

Security and privacy are paramount concerns for any application handling sensitive financial data, and the Leading Personal Finance App addresses these concerns through robust measures designed to protect its users. From the outset, the app employs industry-standard encryption protocols to safeguard user information from unauthorized access. This includes encryption of data both in transit and at rest, ensuring that any data exchange between the user's device and the app's servers remains secure. Moreover, the app incorporates multi-factor authentication processes, adding an extra layer of security that goes beyond simple password protection. By requiring additional verification steps, users can rest assured that their accounts remain secure even if their primary credentials are compromised. On the privacy front, the app strictly adheres to regulatory standards, ensuring that user data is never shared with third parties without explicit consent. Transparency in data practices is facilitated through clear privacy policies that inform users about data collection and usage, fostering trust and accountability. Additionally, users have the flexibility to manage their privacy settings, thereby controlling the degree of access the app has to their personal data. Regular security audits and penetration testing are conducted to identify and rectify potential vulnerabilities, reinforcing the app's commitment to providing a secure financial platform. By prioritizing security and privacy, the app not only safeguards users from potential cyber threats but also builds a reputation based on trust and reliability, which is crucial in the competitive landscape of personal finance applications. This commitment to security ensures that users can confidently manage their finances without the lingering fear of data breaches or identity theft, further enhancing the app’s value proposition.

The Future of Personal Finance Applications

The future of personal finance applications like the Leading Personal Finance App lies in continued innovation and adaptation to the evolving needs of users. The ongoing development of artificial intelligence and machine learning technologies offers immense potential to further personalize user experiences. These technologies can provide deeper insights into spending patterns, predictive financial modeling, and tailored financial advice that aligns perfectly with individual financial goals. Additionally, as blockchain technology becomes more mainstream, there's a potential for enhanced transaction security and transparency, which could be integrated into personal finance apps to provide decentralized financial management options. The future could also see the incorporation of more advanced gamification strategies, making financial management a part of everyday life in more engaging ways. Moreover, expanding the app's capabilities to integrate with various financial platforms, such as cryptocurrency exchanges, could offer users a more comprehensive view of their financial portfolio. The demand for financial inclusivity and accessibility means that these apps will continue to expand their features to cater to underserved populations and emerging markets, breaking down barriers to financial management tools around the globe. As user expectations grow, these apps will need to continuously innovate, offering features that go beyond mere transactional capabilities, incorporating holistic financial wellness services and tools. The ability to adapt and grow with technology and user needs will redefine the landscape, making personal finance apps not just a tool but a vital component of daily financial management. Ultimately, the convergence of technological advancements and user-focused innovations will determine the trajectory of personal finance applications, ensuring they remain indispensable tools for managing and optimizing individual finances.

For those interested in experiencing the Leading Personal Finance App’s full suite of features, it is readily available for mobile users. Download for Android or Download for iPhone and explore the smart and easy way to manage your money effectively.

Share Your Opinion

Your Email Will Not Be Published.

All Rights Reserved © Apps Home 2025

Guy

Moneylion is outstanding, I've used it now for 4 years and still find them going above and beyond to help you have an enjoyable experience. I've sl...

Michelle Greenfield

I've been with MoneyLion for over a year. I'm still here for a reason. The app is easy to use and even though the $19.99 per month fee may seem lik...

Rachel M

This app has plenty of tools to help sort out your finances, get your paycheck early with direct deposit, rebuild your credit with the builder card...

Steffan Giuliani

Honestly, it's a pretty tight service. The customer service is top-notch. The app layout is a little busy, but once you get familiar with searching...

Catherine Maybush

So to be completely honest I was unsure about this app. I had heard of it before, but never known anyone to use it. I decided two months ago to giv...