Apps Home

Revolutionizing Financial Management with Mobile Technology

The advent of mobile technology has proliferated a remarkable transformation in financial management, enabling individuals to effortlessly manage their accounts via smartphones. This evolution is a testament to the convergence of technology and finance, resulting in streamlined strategies that allow users to engage with their financial health in real-time. Historically, account management demanded significant time and effort, including visiting financial institutions or manually tracking expenses and balances. Mobile applications have simplified these processes, offering an all-encompassing solution at users' fingertips. This ease of access extends beyond mere convenience; it signifies a democratization of financial management, where users assume control over their accounts with unprecedented efficiency. With apps that provide features such as balance tracking, transaction notifications, and bill payments, users equip themselves with the necessary tools to make informed decisions. The integration of these functionalities cultivates a comprehensive overview of one's financial ecosystem, an essential component for establishing financial literacy. Furthermore, the rise of mobile platforms underscores the emphasis on security measures designed to protect sensitive information. Biometric authentication, such as Touch ID and Face ID, are examples of innovations that enhance user security, reinforcing trust in mobile account management tools. As these technological advancements continue to evolve, they render financial management a more intuitive and seamless component of daily life.

Your Mobile as a Financial Command Center

In a world where time equates to money, the utility of a smartphone as a financial command center is immeasurable. Platforms like the official American Express app exemplify how mobile devices perpetuate efficient financial governance. Users can access their accounts anytime, anywhere, utilizing a centralized hub to manage expenditures, rewards, and offers. This digital transformation transcends traditional banking experiences, as it facilitates instant account management without the constraints of physical banking hours or locations. For instance, the app notifies users of account charges and suspicious activities, providing reassurance and immediate intervention capabilities. The amalgamation of alerts and real-time data equips users to make timely decisions that align with their financial goals. In addition, the app's AutoPay feature simplifies bill payment procedures, automating the transfer process to eliminate human error and ensure punctuality. By integrating such singular tools, smartphones have revolutionized financial management, making it adaptable and readily available for everyone who seeks to leverage technology financially. The blend of transactional ease with secure, efficient design underscores a significant shift towards a future where your mobile device is not just a communication tool but a pivotal component of your financial strategy.

Security and User Experience: Cornerstones of Mobile Financial Management

Security concerns often accompany advancements in technology, yet the marriage of robust security protocols with enhanced user experience has redefined mobile financial management. The American Express app illustrates this by embracing cutting-edge security features like biometrics and instant card freezing. Users revel in the dual benefits of user-friendly interfaces and the uncompromised security provided by integrated technologies. The capability to instantly freeze and unfreeze credit cards is a noteworthy advancement, affording consumers unparalleled control over their spending even in emergency scenarios. It's a reflection of how companies like American Express are not only reacting to customer needs but proactively anticipating vulnerabilities and instituting preventive measures. The encrypted platforms provide a virtual fortification of private data, ensuring that every interaction within the app meets a rigorous security standard. Meanwhile, the seamless interface design fosters an environment where users can navigate their financial profiles with ease. By focusing on the synergy between security and user experience, mobile financial apps develop a foundation of trust that is crucial for widespread adoption. This duality further establishes these apps as essential instruments for anyone keen on conducting secure, real-time transactions, thus liberating users from traditional banking inefficacies.

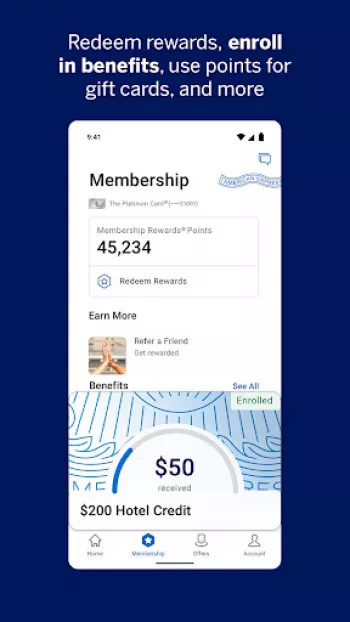

Rewards and Offers: Maximizing Value through Mobile Platforms

The landscape of financial management is not solely about transactions or security; the capability to maximize rewards and benefits stands as a proponent of user engagement. Mobile apps offer a myriad of opportunities for users to enhance their financial returns through meticulously tailored rewards programs and exclusive offers. For example, American Express allows users to access a variety of membership rewards, enabling them to convert expenses into tangible benefits like gift cards, travel credits, or merchandise. The personalized interface extends beyond transaction management to offer recommendations that align with user spending habits, fostering a customized experience that appreciates user loyalty. This integration exemplifies how mobile technology can amplify the value of each dollar spent, transforming routine transactions into opportunities for reward accrual. In addition, digital platforms promote user interaction through referral bonuses and discounts, extending financial benefits to one's social network. By leveraging these tools, users can derive maximum advantage from their financial engagements, experiencing a true return on their membership investments. The synergy of rewards and technology not only incentivizes consistent use but enriches the overall user experience, culminating in a mutually beneficial relationship between the service provider and the consumer.

Continuing Evolution: The Future of Mobile Account Management

As we advance into a future where technology continues to be an integral part of daily life, the domain of mobile account management is poised for further evolution. Continuous innovations are constantly being introduced to enhance user interaction with their financial accounts. For instance, the integration of artificial intelligence can foreseeably provide predictive financial advice, from budget management to investment recommendations, tailored to individual users' financial behaviors and goals. Such AI-driven functionalities could revolutionize personal finance by dynamically adapting strategies as a user's financial life evolves. Additionally, the inclusion of digital currencies and blockchain technology presents an untapped avenue for mobile financial platforms to explore, offering real-time cross-border transactions and secure digital asset management. As platforms expand their functionalities, the amalgamation of advanced analytics and machine learning will further refine security measures, while also offering insights into transactional patterns. The upcoming era in mobile financial management promises a deeper, more holistic approach to card services, extending beyond mere transactional capabilities to become an intrinsic part of one's financial well-being. As we stand on the cusp of this transformation, the journey of financial management via mobile devices will likely become more sophisticated, personalized, and indispensable, ensuring that users remain at the forefront of technological advancements in finance.

Share Your Opinion

Your Email Will Not Be Published.

All Rights Reserved © Apps Home 2025

Gibzen

Never had an issue with the app -- like the interface, and aesthetic. AMEX- LISTEN UP -- the app is missing one simple, critical feature; no abilit...

David bowers

Not a bad app. My only complaint that I know of is. I'm unable to open/ see what experiences are available to me. I click the travel and experience...

A Google user

This app is very practical and usually reliable. But there is one annoying flaw. Each time the app is updated, it "forgets" my settings for Spendin...

josie

When you're actually signed in, everything works fine. Information displays easy enough, the UI is mostly easy to navigate and pleasing to use, and...

Chris Pope

The current balance is not included below each transaction, making it extremely difficult to track how much you've charged. Other apps I've used su...