Apps Home

The Rise of Smart Banking Apps for Business

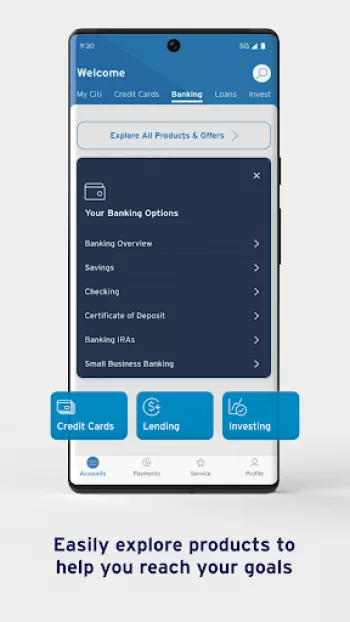

In today's fast-paced digital world, businesses are increasingly reliant on technology to streamline their operations and enhance efficiency. Among the myriad of technological advances, smart banking apps for business have emerged as game-changers. These applications have revolutionized the way businesses manage their finances, offering a suite of features that were once only available by visiting a bank branch. Their rise can be attributed to the ever-growing need for solutions that cater to the dynamic nature of modern business transactions. These smart apps provide business owners with unparalleled access to their accounts, allowing them to perform a range of financial tasks right from their mobile devices. This ease of access is particularly beneficial for entrepreneurs and small business owners who may not have the time to visit a bank branch. With capabilities such as opening checking or savings accounts directly from the app, businesses can bypass traditional barriers and expedite account set-ups without the usual administrative burden. Moreover, the ability to navigate swiftly through the app's intuitive interface means that features like quick card replacement, reviewing account snapshots, and locating fee-free ATMs are just a tap away. The convenience extends to payment solutions as well, with options like Zelle allowing businesses to pay and split payments seamlessly with partners or suppliers, ensuring smoother cash flow management. By integrating these advanced functionalities, smart banking apps have positioned themselves as indispensable tools for businesses aiming for operational efficiency and improved financial oversight.

Revolutionizing Financial Management with Smarter Technologies

The introduction of smarter technologies in banking apps has been a boon for businesses seeking to revolutionize their financial management practices. One of the standout features of such apps is their ability to aggregate multiple accounts, including bank accounts, credit cards, and investment accounts, thereby offering a holistic financial view. This integration allows business owners to monitor and manage their finances from a single platform, reducing the complexity and time associated with juggling multiple financial accounts. Additionally, these apps have ingrained sophisticated spending insight tools that analyze spending trends across accounts. Such insights are invaluable for businesses as they strive to optimize budgets, manage expenses, and identify cost-saving opportunities. Another groundbreaking feature is the management of bills and recurring payments. By centralizing bill management, businesses can see all due payments in one place, eliminating the risk of missing critical payment deadlines. With added functionalities that support automatic payments and easy transfers between accounts, managing cash flow has never been more seamless. Moreover, the ability to dispute credit card transactions directly through the app provides a layer of security and control over unexpected or fraudulent charges. As businesses continue to embrace these smarter technologies, the focus will increasingly shift towards leveraging data-driven insights to make informed financial decisions, ultimately driving business growth and sustainability.

Ensuring Security While Enhancing User Experience

Security is paramount, especially when it comes to handling sensitive financial data. As businesses integrate smart banking apps into their daily operations, ensuring robust security measures is essential. These apps are designed with top-tier security protocols to protect user information and prevent unauthorized access. One of the key features enhancing security is the ability to lock and unlock cards through the app, known as Quick Lock, allowing businesses to quickly secure their accounts in case of lost or misplaced cards. Additionally, resetting the debit card PIN directly from mobile devices adds an extra layer of protection, preventing fraud and unauthorized transactions. The incorporation of biometric authentication methods, such as fingerprint scanning, has further strengthened app security while simultaneously simplifying access for users who seek convenience without compromising safety. Furthermore, businesses benefit from receiving personalized account alerts tailored to their preferences, ensuring they stay informed of any suspicious activity in real time. As security threats continue to evolve, these smart banking apps remain at the forefront by integrating innovative security measures, all while ensuring a smooth and user-friendly experience. This delicate balance of security and usability is what makes these apps so appealing to businesses, as they provide peace of mind knowing their financial data is protected without sacrificing operational efficiency.

Understanding Customer Needs Through Personalization and Innovation

One of the cornerstones of successful smart banking apps is their ability to understand and meet customer needs through personalization and continuous innovation. Businesses today demand solutions that are tailored to their specific requirements, and modern banking apps are delivering just that. By offering customizable features such as changing the due date on credit cards to better align with cash flow cycles, these apps demonstrate a commitment to meeting business needs. Innovative tools that provide free access to FICO® Scores empower businesses with greater insight into their credit health, enabling them to make more informed decisions regarding loans and credit lines. Real-time updates and notifications ensure that users are always up-to-date on their financial status, which is critical for timely decision-making. Furthermore, these apps integrate feedback mechanisms, allowing businesses to voice their experiences and suggest enhancements. This customer-centric approach fosters a sense of partnership between banks and their clients, encouraging loyalty and trust. Through leveraging insights derived from customer interactions and feedback, smart banking apps continuously evolve, ensuring that they remain relevant and valuable in an ever-changing business landscape. This relentless pursuit of innovation is what sets these apps apart, creating a seamless and efficient experience for businesses across the globe.

Accessibility and Convenience at the Forefront of Banking Solutions

The rise of smart banking apps has firmly placed accessibility and convenience at the forefront of banking solutions for businesses. These apps are designed to provide businesses with access to their banking services anytime and anywhere, fundamentally transforming how businesses interact with their financial institutions. With the majority of banking tasks now executable through these apps, businesses enjoy unprecedented flexibility in managing their finances. The use of smart shortcuts and fast navigation options further enhances user experience, allowing quick access to the app's most used features. The introduction of mobile check deposit functionality represents another paradigm shift, enabling businesses to deposit checks digitally without visiting a physical branch. As the need for remote banking solutions grows, smart banking apps provide a vital lifeline for businesses operating in diverse environments. Moreover, the availability of over 60,000 fee-free ATMs for cash management reflects the app’s commitment to blending digital and traditional banking needs. This level of access ensures that businesses remain agile, able to respond swiftly to market demands and financial requirements. Ultimately, the strategic integration of digital advancements sets forth a new era of convenience-driven banking, offering Download for Android as a testament to their wide-reaching impact and vital role in modern business practice.

Share Your Opinion

Your Email Will Not Be Published.

All Rights Reserved © Apps Home 2025

Rachel Hanks

The app can be buggy and goes through periods where it won't load anything I click, but it eventually gets fixed each time. I love the app when it'...

Colton Johnson

Love the app. My only complaint would be occasionally it is under maintenance and does not allow me to use the app for long periods of time. Aside ...

Stephen Torain (SMT)

The app works really well. Paying my card bill & seeing my account balances is simple. Movement of money is pretty easy too. It is a bit cumbersome...

Michael Meyer (Mikey)

The app is generally good, but there are areas for improvement. The layout is user-friendly, and I appreciate the comprehensive features available....

Peekabooihateu

I really do like this app. Super convenient. Unfortunately like some others my biometric option hasnt been working the last couple of months. Once ...