Apps Home

Understanding Stock Markets and Trading Fundamentals

The stock market is an intricate ecosystem, encompassing not only the actual trading of stocks among investors but also a wide array of associated concepts and institutions that facilitate these transactions. To optimize stock trading, one must first understand the foundational elements of the stock market. A crucial starting point is recognizing the function of stock exchanges where the buying and selling of stocks occur. Stock exchanges, like the New York Stock Exchange (NYSE) and NASDAQ, offer platforms for traders to transact in a secure and regulated environment. They ensure that there is a systematic way to match buy and sell orders, which enables liquidity and price discovery. Traders must also familiarize themselves with broader market concepts, such as market capitalization, which helps categorize stocks into various segments such as small-cap, mid-cap, and large-cap. This classification aids investors in assessing risk and potential return, considering that smaller companies generally provide higher growth potential but also entail greater volatility. Understanding indices like the S&P 500, which represent the performance of large sectors of the market, is essential as they offer a snapshot of the market's health and can influence trading decisions. The stock market functions on the principle of supply and demand, and hence, technical analysis tools that track price movements and trends become indispensable. Indicators like moving averages, relative strength index (RSI), and Bollinger Bands are pivotal in evaluating the momentum and volatility of stocks. Traders utilize these tools to make informed predictions about price movements. Fundamental analysis, another cornerstone of trading, involves examining a company's financials such as earnings reports, balance sheets, and cash flow statements, which offer insights into the company’s performance and future prospects. Integrating technical and fundamental analysis allows traders to make more holistic and informed decisions, balancing short-term price forecasts with long-term growth potential. Thus, understanding the basics of stock trading is not just about the act of buying low and selling high but involves a comprehensive synthesis of market mechanics, analysis techniques, and economic indicators that shape the world of stock trading.

Strategies for Optimal Trading in Volatile Markets

Trading in volatile markets requires a nuanced approach that balances risk management with the pursuit of profit. The first key strategy involves diversification, inherently lowering risk by spreading investments across different asset classes, sectors, or geographical regions. This is crucial in volatile markets as it mitigates the impact of a downturn in any single investment. Traders often construct diversified portfolios to protect against sudden market shifts. Moreover, employing hedging techniques such as options and futures contracts can provide a safety net insuring against adverse market movements. For instance, options allow traders to secure the right to buy or sell a stock at a predetermined price, offering a measure of control over potential losses. Another vital strategy is the implementation of stop-loss orders, acting as a pre-determined selling point to avert significant losses. Stop-loss orders are especially useful in volatile markets to automatically close positions once a stock hits a particular price, thus removing the emotional bias from decision-making. In addition to technical defenses, adopting a contrarian approach can yield benefits in uncertain markets. This entails buying stocks that are out of favor with the broader public but are fundamentally sound, assuming the market may be undervaluing them. A contrarian strategy relies heavily on thorough research and courage to oppose prevailing market sentiment. Active monitoring and quick reaction to market news can also provide a competitive edge. Staying informed about geopolitical events, economic indicators, and corporate announcements ensures traders are not caught off guard. Moreover, utilizing algorithmic trading software that executes pre-set trading instructions based on statistical analysis and trading signals allows for precision and speed that manual trading cannot match. Psychological resilience and discipline are equally important, aiding traders in maintaining composure when market volatility challenges their strategies. Overall, optimal trading in volatile markets demands an adaptive approach involving strategic planning, risk mitigation tactics, and emotional discipline to exploit opportunities while safeguarding investments.

The Role of Technology in Modern Trading

In the contemporary trading arena, technology plays an integral role, transforming how stocks and markets are analyzed, traded, and monitored. One primary advancement is electronic trading platforms, which provide traders with real-time market data, efficient transaction processing, and comprehensive analytical tools. These platforms, accessible via desktops and mobile devices, democratize trading, allowing individuals across the globe to participate. Features such as interactive charts, market scanners, and algorithmic trading capabilities put sophisticated trading tools into the hands of active traders and investors. The rise of artificial intelligence (AI) and machine learning has further revolutionized trading by enabling systems to analyze vast amounts of data and identify patterns that human traders might miss. AI can generate trading signals, automate trading processes, and even develop self-improving models through reinforcement learning. This technology empowers traders to optimize their strategies by predicting market trends and testing them using historical data in simulated environments. High-frequency trading (HFT), utilizing powerful computer algorithms, allows traders to execute a large number of orders within fractions of a second, capitalizing on small but frequent profit opportunities. Although HFT is typically employed by large institutions due to the technical infrastructure required, its presence underscores the importance of speed and accuracy enabled by technology. Furthermore, blockchain technology is beginning to influence trading by offering secure and transparent transaction capabilities, potentially reshaping traditional trading platforms' backend operations. As a result, traders must remain abreast of emerging technologies and software developments in trading, regularly updating their skill sets to harness the latest tools effectively. Particularly, mobile applications improve accessibility, and downloading a trading app can make real-time trading data and trading execution available literally at one's fingertips. This accessibility allows traders to remain connected to the markets and respond to developments instantly, thereby optimizing their trading opportunities.

Evaluating Performance and Learning from Market Trends

To become an accomplished stock trader, regularly evaluating performance and learning from market trends is essential. Performance assessment involves a systematic review of past trades to measure success and identify areas for improvement. Traders should meticulously record details of each trade, including entry and exit points, reasons for the trade, and the outcome. Analyzing this data helps in distilling patterns in trading behavior, identifying strategic strengths, and pinpointing weaknesses that need to be addressed. It's crucial for traders to set clear benchmarks and compare them against broader market indices, providing context to individual performance. Benchmarking against indices like the Dow Jones Industrial Average or the NASDAQ Composite helps ascertain whether one's strategy yields superior returns compared to standard market offerings. Additionally, performance metrics, such as the Sharpe ratio, which assesses risk-adjusted return, and maximum drawdown, which measures potential losses, are critical analytical tools for understanding trading efficiency. Beyond personal performance, traders must stay attuned to broader market trends, which inform future trading strategies. This requires a robust understanding of economic indicators, political developments, and sectorial changes that influence market dynamics. Technical analysis can unveil cyclical patterns and potential trend reversals, providing insights into optimal trading windows. Educational resources, such as webinars, trading courses, and financial literature, further augment a trader's ability to interpret market movements correctly. These resources equip traders with the knowledge needed to anticipate shifts based on historical performance, leveraging empirical data to refine their strategies. Ultimately, the continuous cycle of performance evaluation and market trend analysis forms a foundation for sustained success in stock trading.

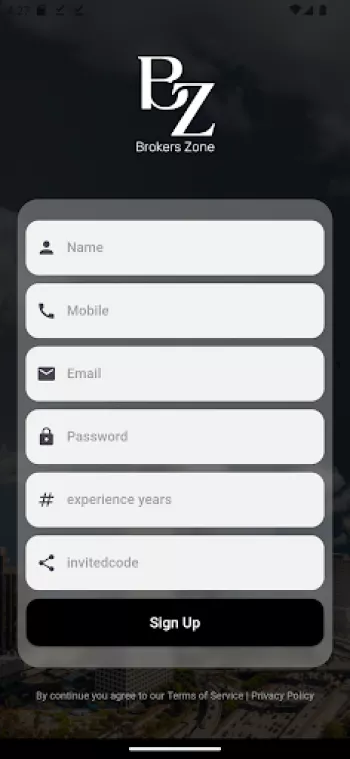

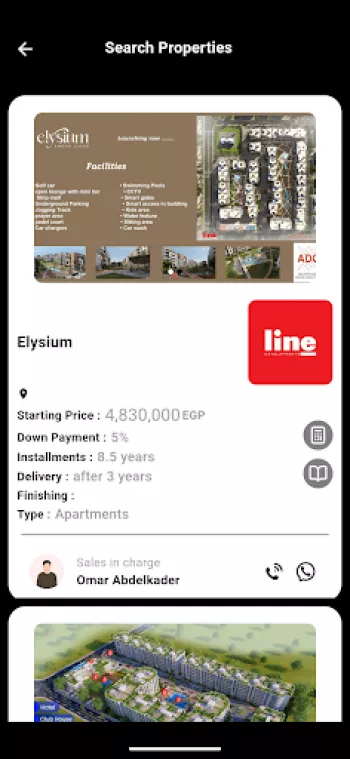

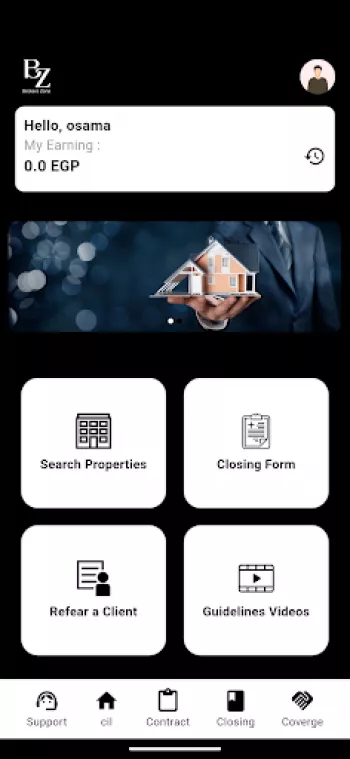

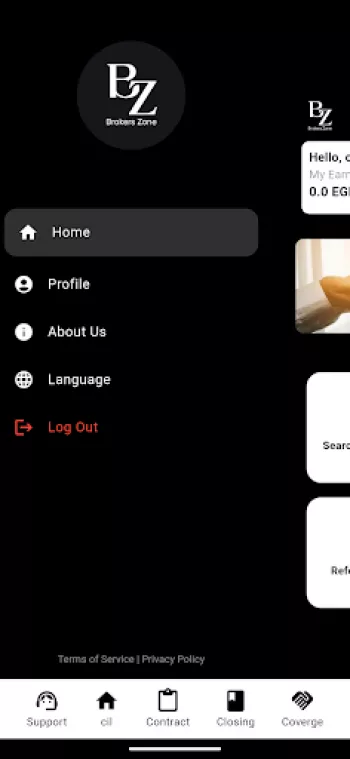

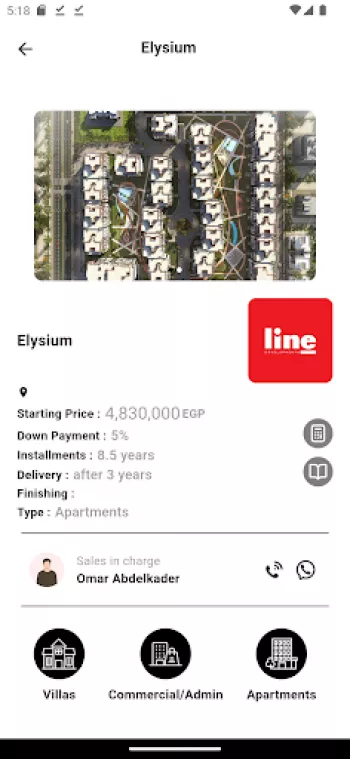

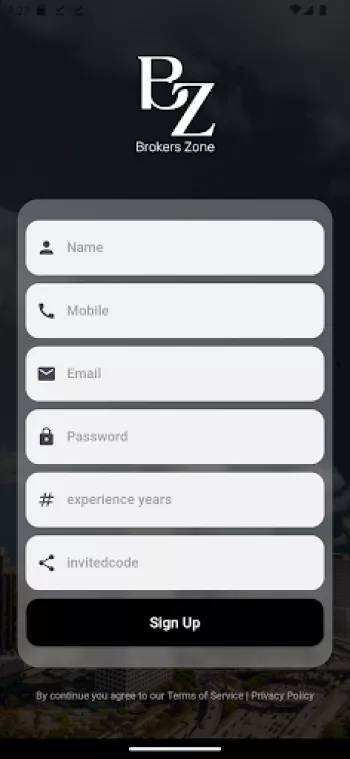

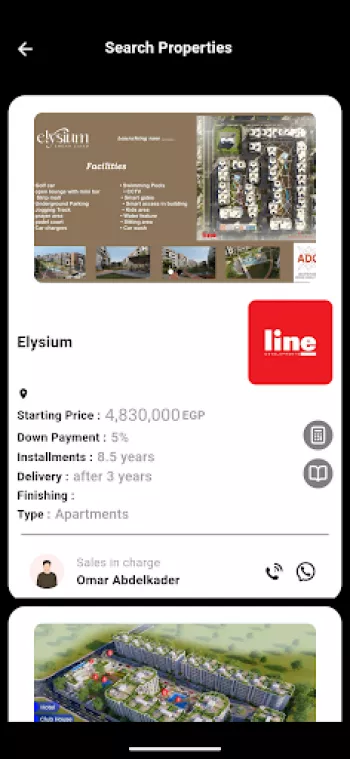

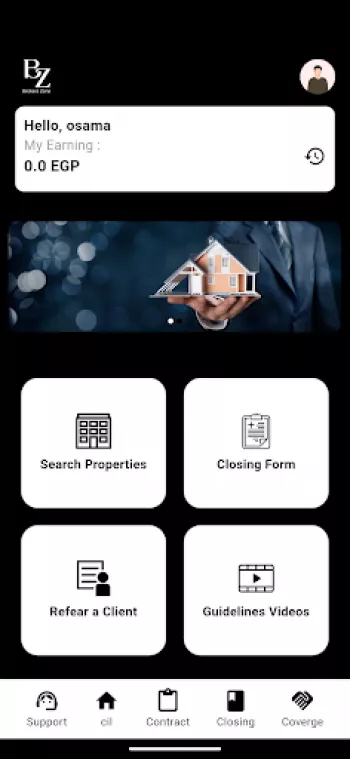

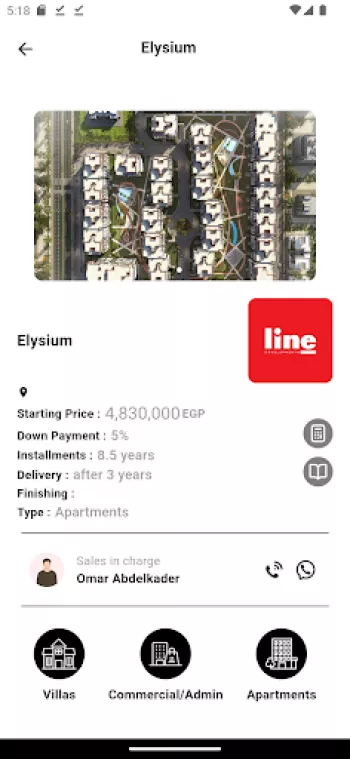

Embarking on the Trading Journey with Brokers Zone

For aspiring traders looking to embark on their trading journey, resources and platforms like Brokers Zone offer invaluable support. We believe everyone should have the chance to engage in the real estate market, providing tools and data that empower you to make informed decisions when trading. Through our platform, you gain access to a comprehensive virtual assistant designed to streamline the property search process, enriching your ability to find viable trading opportunities without the usual complexities associated with real estate transactions. By leveraging our application, novice traders can confidently explore the market with a sound understanding of legalities and negotiations provided by Brokers Zone, effectively lowering the barriers to entry. The most significant advantage of integrating Brokers Zone into your trading routine lies in its commission system, where informing developers of your membership facilitates obtaining up to 85% of the commission when a deal closes. This arrangement maximizes your earnings, allowing you to primarily focus on strategy development and execution rather than administrative details. With smart connections directly to developers and efficient information delivery, our platform enhances your ability to succeed. In line with the technological advancements in the trading landscape, Brokers Zone provides a user-friendly mobile app, easily accessible on multiple platforms, ensuring you have the essential tools at your disposal. Interested users can easily Download for Android to experience the platform's benefits firsthand. Joining Brokers Zone means having a steadfast partner committed to simplifying and amplifying your real estate trading journey. This commitment to excellence and innovation primes traders to achieve their real estate ambitions with intelligence and ease.

Share Your Opinion

Your Email Will Not Be Published.

All Rights Reserved © Apps Home 2025

Alaa Rady

ابلكيشن بيسهل كل حاجه الصراحه وقفلت معاهم ديل وكل حاجه كانت تمام