Apps Home

Fast Budget - Expense Manager

Understanding the Fundamentals of Budget Management

Budget management, in its essence, refers to the systematic approach of managing financial resources to achieve specific financial goals. This process involves not just tracking income and expenditures, but also planning, saving, and forecasting future financial positions. Understanding this concept requires a grasp of financial literacy, which many lack despite its critical importance in everyday life. Many find budgeting intimidating due to the jargon or technical aspects involved, yet at its core, it is about achieving financial stability and freedom. For instance, creating a budget plan begins with recognizing all your sources of income, which could include salary, dividends, or secondary earnings such as freelancing. Once your income streams are identified, the next step is to categorize your expenses – both fixed and variable. Fixed expenses include rent or mortgage payments, utility bills, and insurance premiums, which remain more or less constant every month. On the other hand, variable expenses, such as groceries, dining, and entertainment, can fluctuate. The objective is to ascertain where your money goes and identify potential areas where savings can be made. The process is rooted in the golden rule of budget management: spend less than you earn. Understanding cash flow and liquidity is crucial here, as is having a buffer in the form of an emergency fund for unexpected costs. In an age where apps and digital tools like Fast Budget - Expense Manager have made budget management more accessible, users can easily track and automate this process. The integration of technology in budget management not only simplifies this task but also adds a layer of accountability by sending reminders or notifications when a budget limit is reached or a recurrent payment is due.

Leveraging Technology for Efficient Budget Tracking

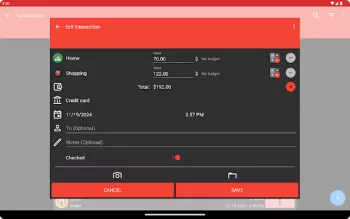

The advent of technology has revolutionized the way individuals and families manage their budgets. Traditional methods of jotting down expenses on paper or using complex spreadsheets have gradually been supplanted by more efficient, automated systems. Budget management applications like Fast Budget provide users with a comprehensive suite of tools designed to make financial tracking both simple and powerful. These apps offer features such as the creation of customized accounts and credit card tracking, which can visually represent one's financial health through customizable charts indicating spending trends over time. For instance, users can input their transactions manually or opt for automatic feeds from bank accounts, thus keeping track of purchases in real-time. Moreover, these tools often come with templates or widgets that expedite transaction entries, ensuring that financial data is up-to-date. Importantly, technology allows for the scheduling of recurrent payments, reducing the risk of missed deadlines, such as bills or subscription services, by setting reminders. Integrated calendar features not only track past and present financial activity but also provide projections for future inflows and outflows, effectively offering a full-fledged financial diary. Synchronization capabilities ensure that data remains consistent across multiple devices, catering to the modern consumer's multi-device lifestyle. This is enhanced by the potential for exporting data in various formats like PDF, CSV, or XLS, allowing for comprehensive review and analysis over time. Such technological advancements have democratized budget management, making it accessible to a broader audience and fostering a culture of proactive financial planning rather than reactive responses to financial crises.

Creating Successful and Adaptable Budget Plans

Creating a successful budget plan is a personal journey that requires flexibility and adaptability. Unlike rigid financial planning that may become obsolete with changing circumstances, adaptable budgeting reflects a real-world understanding of fluid financial landscapes. Personal financial situations can change due to various factors – a career switch, an unexpected expense, or shifts in lifestyle priorities can all affect how one manages their finances. Therefore, a good budget plan must allow for periodic adjustments and re-evaluations. This begins by setting realistic financial goals that align with your current financial status and future aspirations. Long-term goals might include buying a house, retirement savings, or education planning for children, while short-term goals could involve building an emergency fund or saving for a vacation. Using tools like Fast Budget - Expense Manager, individuals can create tailored budgets that categorize spending into personal, family, or business expenditures. Budgets can be divided by category or duration, offering a clear blueprint for spending. Multiple categories for each budget can mix and match your financial undertakings, thereby providing a multi-dimensional view of your financial standing. Importantly, monitoring these customized budgets prevents overspending and allows for the improvement of saving habits. However, budgets should not be so strict as to ignore the element of enjoyment or sporadic self-indulgence. A practical budget acknowledges that occasional treats are part of a balanced life, as long as they are planned for and controlled. Reviewing and adjusting budgets regularly ensures they continue to meet personal needs and conform to any changes in income or expense patterns.

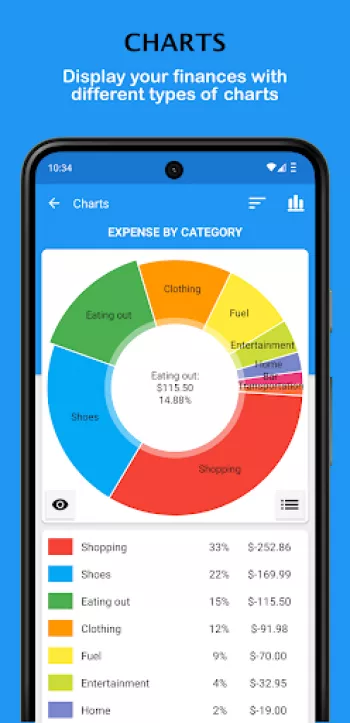

Using Analytical Tools to Enhance Financial Decision Making

In the realm of budget management, analytic tools are indispensable for informed financial decision-making. These tools provide insights that are not immediately apparent, allowing users to uncover patterns, trends, and anomalies in their financial behavior. Fast Budget - Expense Manager offers a range of sophisticated analytical options via its customizable charts, which enable users to visualize their financial data dynamically. These visualizations help in understanding where the majority of one's money is being spent, and more importantly, highlight unnecessary expenses that can be curbed. Different types of charts, such as bar graphs, pie charts, and trend analysis, offer diverse perspectives on consistent savings opportunities and identify potential financial pitfalls. Moreover, tracking transactions across different accounts and observing the evolution of credit and debt provides a holistic picture of financial health. One notable feature is the capability to connect bank accounts directly with budgeting tools, which facilitates the real-time updating of financial status. This provides a more accurate representation of one's fiscal situation, allowing for precision in financial planning. Moreover, such tools often include predictive analytics capabilities, providing insights into future spending, saving trajectories, or debt paydown based on historical data. This allows users to make adjustments as necessary, enhancing the ability to make strategic decisions that align with their life goals. The cumulative effect of leveraging these analytical tools is not only an improved understanding of personal finances but also increased confidence in financial decision-making, paving the way for achieving life-long financial security.

Integrating Budget Management into Everyday Lifestyle

Budget management should not be viewed as an isolated activity but as a critical element of everyday lifestyle practices. Successfully integrating this discipline requires changing the way financial decisions are approached and embedding a financial consciousness into daily routines. It's about an ongoing commitment to aligning spending habits with personal values and life goals. Individuals can start by engaging with tools like Fast Budget - Expense Manager, which make financial management less of a chore and more of a routine check-up. Easy-to-use apps and web-based platforms can be set up to provide daily or weekly reports, reminders, and alerts that keep individuals consistently informed of their financial position. This kind of integration promotes greater financial awareness, ensuring that the consequences of financial decisions are constantly under consideration. Furthermore, through features like passcode protection and cloud backup via Dropbox, these tools offer robust solutions for data security and accessibility. It's important to utilize such features for efficient and safe data management. A synchronized approach using multiple devices ensures that whether one is at home, at work, or on the go, they can track and manage expenses seamlessly. Resources previously invested in financial oversight now contribute directly to one's quality of life, thereby making budgeting a lifestyle choice rather than a necessity. By fostering a mindset that sees budget management as a pathway to achieving financial dreams, individuals and families can transform their financial reality, leading to more sustainable living and greater peace of mind.

Download for AndroidShare Your Opinion

Your Email Will Not Be Published.

All Rights Reserved © Apps Home 2025

lei

Easy to use and practical!! Super helpful app. I would, however, appreciate it more if it also shows the total & average expense per category. That...

A Google user

For me, this app was easy to learn. Once your expenses and income categories are set up on the app, it's a cinch to record each item. I upgraded to...

A Google user

After trying about a ~20 different app, this is hands down the best money-tracking app I've ever used! The one thing I would like to see is an asth...

Nicole S

After trying over 20 apps, I revisted this one. I would consider it more indepth than fast, esp compared to simple budgeting apps but now that I'm ...

A Google user

I tried out many budgeting apps before finding this perfect one. It is very simple to use and allows you to add multiple accounts, as well as credi...