Apps Home

Introduction to Leading Personal Finance Management

The advent of technology in finance management has revolutionized the way individuals manage their own money. "Leading Personal Finance App" embodies the pinnacle of personal finance solutions, providing users with not only a seamless experience but also comprehensive financial guidance to make smarter monetary decisions effortlessly.

Comprehensive Financial Management

This cutting-edge app offers an entire suite of financial tools, enabling users to manage their finances with ease and precision. Whether it's accessing mobile banking, obtaining personal loans, or receiving fast cash advance options, this app ensures that users are well-equipped to handle any financial situation with confidence.

Play and Earn with MoneyLion Games

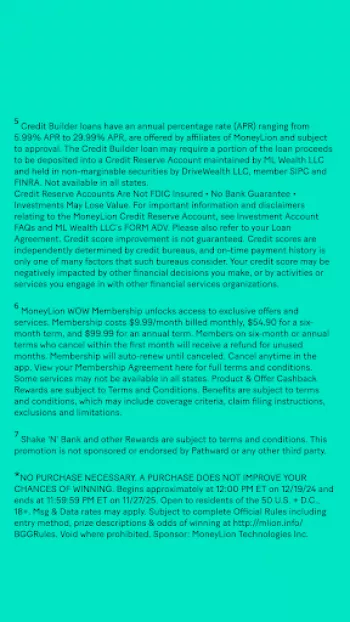

The integration of gamification with financial management sets this app apart. Users can engage in fun games and simultaneously earn real money. It's an innovative approach that not only entertains but also provides daily opportunities to earn cashbacks, up to $50 per game, making financial planning an engaging activity.

Exclusive Banking Services

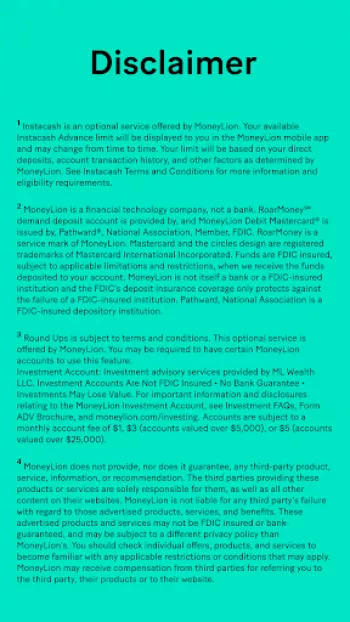

Partnering with RoarMoney, the app allows users to benefit from advanced banking services. With a RoarMoney account, one can receive direct deposits up to two days early, a significant advantage in managing cash flow effectively. Moreover, by using the Round Ups feature, users can invest their spare change, ensuring that every cent counts.

Instant Accessibility with Cash Advances

Monetary emergencies require swift action, and the app offers Instacash facilities that users can access without interest or mandatory fees. Up to $500 can be advanced from your paycheck any day, with no need for a credit check, ensuring financial stability is never out of reach. This optional service, offered by the app, provides the flexibility needed for unforeseen expenses.

Loan and Credit Management

For those looking to enhance their credit score, the app provides Credit Builder loans. These loans not only improve credit ratings but also offer exclusive membership services. Alternatively, users can explore diverse personal loan options available through the MoneyLion Marketplace, with repayment terms adjustable from 12 to 84 months.

Cashback and Rewards System

The rewards system integrated within the app allows users to earn cashback on significant financial decisions as well as daily expenditures. Additional protections, such as cell phone insurance and travel benefits, add an extra layer of safety and peace of mind for users, enhancing their financial resilience.

Conclusion

The app offers an unparalleled personal finance management experience, blending innovation with practicality. By providing a dynamic range of services, from gamification and banking to loans and rewards, this app truly is the smart and easy way to manage money efficiently. Access the full suite of services and transform your financial management today by downloading the app on Android or iPhone.

شاركنا رأيك

بريدك الالكتروني لن يتم نشره.

All Rights Reserved © Apps Home 2025

Guy

Moneylion is outstanding, I've used it now for 4 years and still find them going above and beyond to help you have an enjoyable experience. I've sl...

Michelle Greenfield

I've been with MoneyLion for over a year. I'm still here for a reason. The app is easy to use and even though the $19.99 per month fee may seem lik...

Rachel M

This app has plenty of tools to help sort out your finances, get your paycheck early with direct deposit, rebuild your credit with the builder card...

Steffan Giuliani

Honestly, it's a pretty tight service. The customer service is top-notch. The app layout is a little busy, but once you get familiar with searching...

Catherine Maybush

So to be completely honest I was unsure about this app. I had heard of it before, but never known anyone to use it. I decided two months ago to giv...